How to Apply for Capital One Venture X Credit Card Step-by-Step Guide

The Capital One Venture X credit card offers exceptional travel rewards with 2x miles on all purchases and 5x on bookings through Capital One Travel. Enjoy a substantial welcome bonus, premium travel perks including airport lounge access, an annual travel credit, and no foreign transaction fees for seamless global spending.

Tips to Maximize Credit Card Rewards and Benefits

Learn effective strategies to maximize credit card rewards and benefits. Discover how to choose the right card, leverage sign-up bonuses, stay informed about promotions, and utilize auto-pay for bills. With informed choices and disciplined spending, you can enhance your financial rewards and savings over time.

Impact of Letters of Credit on Small Businesses: What You Need to Know

Letters of Credit play a crucial role in enhancing small businesses' financial stability, providing credibility, reducing risks in international trade, and facilitating smoother transactions. Understanding their types and benefits empowers entrepreneurs to navigate cross-border dealings effectively, ultimately fostering growth and a competitive edge in the global marketplace.

How to Choose the Ideal Credit Card for Your Financial Needs

Finding the perfect credit card requires evaluating your spending habits, understanding associated fees, and recognizing your credit score. Focus on rewards that align with your lifestyle, assess interest rates, and consider user reviews. This approach ensures you select a card that supports your financial needs and goals effectively.

The Pros and Cons of Using Credit Cards for Young Adults

Credit cards can be valuable for young adults, helping to build credit history and offer rewards. However, risks like high interest rates and overspending exist. Understanding both pros and cons is essential for responsible credit card management, ensuring financial health and informed decision-making.

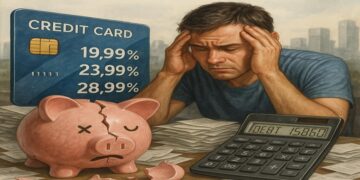

The Effects of Credit Card Interest Rates on Financial Health

High credit card interest rates can severely impact financial health, leading to debt accumulation and stress. Understanding these rates and employing proactive strategies, like monitoring spending and establishing emergency funds, can mitigate risks, enhance credit scores, and foster long-term economic stability and well-being.

Strategies to Avoid Credit Card Debt During Year-End Shopping

The year-end shopping season is exciting but can lead to credit card debt. To avoid this financial strain, establish a strict budget, create a detailed shopping list, and track spending. Use cash, compare prices, and leverage discounts wisely to enjoy holiday shopping without overspending or accruing debt.

How to Build a Healthy Credit History with Credit Cards

Building a healthy credit history with credit cards is crucial for financial success. By making timely payments, managing credit utilization, and diversifying credit types, individuals can improve their credit scores and secure better financing opportunities. Regular monitoring and responsible usage are key to maintaining a strong credit profile.

Difference Between Credit Card and Prepaid Debit Card

This article explores the distinctions between credit cards and prepaid debit cards, highlighting their unique benefits and limitations. It emphasizes the importance of considering personal financial goals and habits, helping readers make informed choices about which payment method suits their needs best.

How to Apply for Firstcard Secured Credit Builder Card Today

The Firstcard Secured Credit Builder Card helps you establish or improve your credit with low fees and competitive rates. Enjoy reliable support and flexible credit limits to match your needs, ensuring financial control and security. Pay on time to boost your credit profile efficiently.