Investment Diversification: How to Minimize Risks in Times of Economic Instability

In today’s unpredictable financial landscape, understanding how to safeguard your investments is more critical than ever. Economic instability can arise from various factors, such as:

- Global pandemics

- Political uncertainty

- Natural disasters

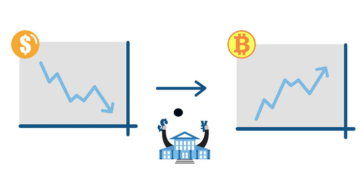

These events can lead to market volatility, making it essential for investors to adopt a proactive approach to protect their assets. One highly effective strategy is investment diversification, which involves spreading your investments across various asset classes to minimize exposure to risk. Here’s why this approach is particularly important:

- Minimizes potential losses: If one investment performs poorly, the impact on your entire portfolio can be reduced. For instance, if you invest solely in the stock market and a recession occurs, you could face significant losses. However, by diversifying your investments, such as through bonds or real estate, your overall portfolio may suffer less or even remain stable.

- Provides exposure to various sectors: By including various industries in your portfolio, you reduce reliance on any single sector. For example, the technology sector may perform poorly while healthcare stocks are thriving. A diversified portfolio with a range of sectors can better withstand such fluctuations.

- Balances risk and volatility: Different assets have varying risk levels and volatility. Including both high-risk investments (like stocks) and more stable options (like bonds) allows you to balance potential rewards against risks, enhancing long-term stability.

To effectively diversify your investments, consider mixing different asset types in your portfolio. A wise combination could include:

- Stocks: These can offer high returns but also come with higher risks. Look for both growth stocks and dividend-paying stocks for balance.

- Bonds: These are generally less volatile than stocks and provide fixed income, making them an excellent counterbalance in a diversified portfolio.

- Real estate: Investing in real estate or real estate investment trusts (REITs) can provide income and appreciation potential while acting as a hedge against inflation.

- Mutual funds and ETFs: These investment vehicles allow you to invest in a diversified range of securities, often with lower costs and greater ease than buying individual stocks.

By structuring your portfolio in this comprehensive manner, you can enhance your chances of weathering economic downturns. In the following sections, we will explore various strategies and practical tips to achieve effective diversification that suits your individual financial goals and risk tolerance.

CHECK OUT: Click here to explore more

The Foundations of Investment Diversification

Investment diversification is more than just a popular strategy; it is an essential principle for navigating the complexities of the market, especially during economic turbulence. At its core, diversification means not putting all your eggs in one basket. By spreading your investments across different asset types, sectors, and geographical regions, you can cushion your portfolio against the shocks of market volatility.

To illustrate how diversification works, consider the various asset classes each playing a unique role in your investment strategy:

- Equities (Stocks): Investing in stocks offers the potential for high returns, but it comes with specific risks. Growth stocks, which reinvest earnings to expand their business, can provide considerable upside but may also lead to significant losses in downturns. On the flip side, dividend-paying stocks offer a steady income stream, further balancing your investment.

- Fixed Income (Bonds): Bonds are typically seen as safer investments compared to stocks. They are less volatile and provide regular interest payments, which can help stabilize your overall portfolio during periods of economic uncertainty. By including government and corporate bonds, you create a buffer against fluctuating equity markets.

- Real Estate and REITs: The real estate market can act independently of stock market trends. By investing in physical properties or Real Estate Investment Trusts (REITs), you open up a possibility for both rental income and capital appreciation. Historically, real estate has also been a good hedge against inflation.

- Mutual Funds and Exchange-Traded Funds (ETFs): Mutual funds and ETFs pool together money from multiple investors to buy a diversified array of securities. They are an excellent way to gain exposure to various asset classes without the need to manage each investment individually, thus simplifying your diversification efforts.

When creating a diversified portfolio, it is crucial to be mindful of your risk tolerance and investment goals. Younger investors, for example, may have a higher risk tolerance and choose a more aggressive mix leaning heavily on equities for growth. In contrast, a retiree may prefer a more conservative allocation focused on income and capital preservation, favoring bonds and stable dividend-yielding stocks.

Moreover, it’s essential to periodically reassess and rebalance your portfolio. Market shifts can alter the balance of your investments, possibly leading to unintended risks if one sector grows disproportionately. Rebalancing ensures that your asset allocation aligns with desired risk levels and investment objectives.

By understanding the fundamental concepts and strategies of investment diversification, you position yourself to better withstand economic fluctuations. In the next section, we will delve deeper into specific diversification strategies tailored to different financial situations and investment preferences.

CHECK OUT: Click here to explore more

Advanced Strategies for Effective Diversification

While the basic principles of diversification lay a solid foundation, adopting advanced strategies can lead to more robust investment portfolios, especially in economically unpredictable times. Understanding how to layer your diversification efforts can greatly impact your overall potential for stability and returns.

Asset Allocation: The Cornerstone

At the heart of any effective diversification strategy is asset allocation. This involves determining the right mix of different asset classes—essentially balancing risk and return according to your investment timeline and objectives. Research has shown that the way you allocate resources among various assets can account for a significant portion of your portfolio’s performance. A well-thought-out asset allocation not only helps minimize risks but also positions you to take advantage of market opportunities.

For example, during economic downturns when equities may underperform, fixed income securities like bonds tend to provide a safety net. By maintaining a flexible asset allocation strategy that adjusts based on market conditions, you can effectively respond to changes in economic circumstances.

Sector and Industry Diversification

Beyond balancing asset classes, it is essential to diversify within those classes by considering different sectors and industries. The technology sector, for instance, often shows rapid growth but can be volatile; however, consumer staples—such as food and household goods—tend to remain stable even in economic slumps. Investing across various sectors allows you to harness the benefits of potential growth while mitigating risks associated with industry-specific downturns.

A practical approach might involve allocating funds to technology, healthcare, consumer goods, and utilities. If one sector falters due to economic instability, others may provide the stability your portfolio needs. By spreading investments across sectors, you can cushion the impact of sector-specific downturns.

Geographic Diversification: Going Global

Another vital consideration is geographic diversification. Investing solely within the United States may expose your portfolio to risks stemming from domestic economic issues. By incorporating international investments, you can take advantage of growth in emerging markets, which often operate independently of U.S. market cycles.

For example, consider investing in international mutual funds or ETFs that target established markets in Europe and Asia or growing economies in Southeast Asia or Africa. By doing so, you create a more resilient portfolio that can weather local economic storms while benefiting from global growth trends.

Embracing Alternative Investments

In addition to traditional stocks and bonds, consider incorporating alternative investments into your portfolio. Options may include commodities, hedge funds, private equity, and collectibles like art or vintage cars. While these can carry their own risks and require careful consideration, they often have a low correlation with traditional asset classes, making them an effective way to enhance diversification.

For instance, investing in commodities like gold has shown to provide a hedge during economic instability, as its value often rises when market sentiment turns negative. On the other hand, real estate crowdfunding platforms provide an avenue to invest in property markets without substantial capital outlay, thereby adding another layer to your diversification strategy.

By integrating these advanced diversification strategies, investors can better position themselves to ride out periods of economic uncertainty, making informed decisions that align with their long-term financial goals.

CHECK OUT: Click here to explore more

Conclusion

In these times of economic uncertainty, embracing a well-structured and diversified investment strategy is essential for safeguarding your financial future. By understanding the significance of asset allocation, you can create a balanced portfolio that optimally mixes various asset classes to minimize risks. Remember that a diversified portfolio is not just about having multiple investments; it’s about strategically including different sectors, industries, and geographic regions to cushion against local or sector-specific economic downturns.

Furthermore, incorporating alternative investments can provide additional layers of security and potential for growth outside traditional markets. By exploring options such as commodities, real estate, and other tangible assets, investors can add depth to their portfolios while reducing correlation with mainstream financial markets.

It is vital to remain adaptable, continuously reassessing your strategies in light of changing market conditions and personal financial goals. This flexibility, paired with the principles of diversification discussed in this article, equips you to face economic challenges head-on while capturing opportunities as they arise.

Ultimately, the pursuit of sound investment diversification is not simply a strategy; it’s a proactive approach to cultivating resilience in your financial journey. By educating yourself, researching thoroughly, and making informed decisions, you give yourself the best chance to thrive in even the most volatile economic climates.

Linda Carter is a writer and financial expert specializing in personal finance and financial planning. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her knowledge on the Take Care Garden platform. Her goal is to empower readers with practical advice and strategies for financial success.