How to Diversify an Investment Portfolio to Reduce Risks

Understanding Diversification

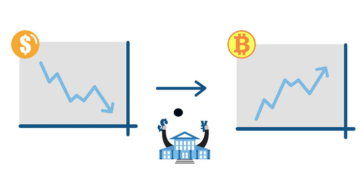

Investing can feel daunting, especially when considering the potential risks involved. Understanding how to diversify your investment portfolio is essential to mitigate these risks effectively. By spreading your investments across various asset classes, you create a buffer against market volatility.

Diversification is not merely a buzzword in investing; it is a vital strategy that helps to protect investors from significant losses. When your portfolio consists of a variety of assets, the negative performance of one can be offset by positive performance in another. This could be particularly valuable during uncertain economic times, such as downturns caused by global events or local market fluctuations.

Key Approaches to Diversification

Diversification can take many forms, and understanding these approaches can help you make informed decisions. Here are a few key strategies to consider:

- Asset Classes: Investing in a mix of stocks, bonds, and real estate allows you to balance high-risk investments with more stable ones. For example, if you have a strong stock investment in technology, you might want to balance it by holding some government bonds that offer lower risk and a steady income stream.

- Sectors: Allocating funds across different industries such as technology, healthcare, and consumer goods ensures that you are not overly reliant on one particular market. For instance, during a pandemic, healthcare stocks may thrive while travel and hospitality sectors struggle. Diversifying your investments across these sectors can maintain your portfolio’s stability.

- Geographic Regions: Considering international investments can provide exposure to different economic conditions and opportunities. For example, while Australia is a robust economy, investing in emerging markets, like parts of Southeast Asia, might offer growth potential that isn’t available at home. This can help reduce overall risk if the Australian market experiences a downturn.

- Investment Styles: Mixing growth and value stocks allows for a combination of strategies. Growth stocks, which are expected to grow at an above-average rate compared to others, might exhibit high volatility, whereas value stocks may provide stable returns and are often less risky. This balance can enhance potential returns without significantly increasing risk.

Each of these strategies plays a crucial role in creating a robust portfolio. For instance, if one sector experiences a downturn, investments in other areas may perform well, helping to preserve your overall wealth. This multifaceted approach is particularly relevant in Australia, where economic conditions can vary greatly between regions and sectors.

In Australia, with its diverse economy, savvy investors have plenty of opportunities for diversification. The key is to understand your risk tolerance and tailor your portfolio accordingly. A well-diversified portfolio not only safeguards your investments but also sets the stage for long-term growth. By implementing these strategies, you can navigate the complexities of investing with greater confidence and prepare for whatever market conditions may arise.

Effective Strategies for Diversification

Diversifying your investment portfolio is not a one-size-fits-all strategy; it requires thoughtful planning and a good understanding of how different investments interact with one another. Implementing a robust diversification strategy involves several key components that can cater to both individual goals and market dynamics. Here are some effective strategies designed to help you mitigate risks through diversification:

- Asset Allocation: Determining the right mix of asset classes is crucial. A general rule of thumb is to consider your age and risk tolerance when allocating. Younger investors might lean more towards stocks for growth, while those closer to retirement may prefer bonds for stability. For example, a 30-year-old could have 80% in equities and 20% in fixed income, while a 60-year-old might adjust that to 50% in stocks and 50% in bonds, aligning with their changing risk profile.

- Sector Diversification: Investing across various sectors not only safeguards your portfolio but also opens up opportunities in markets with different growth cycles. For instance, tech and healthcare might be your go-to sectors; however, including energy and utilities can provide a cushion during economic downturns. If the technology sector faces challenges due to regulatory changes, your investments in healthcare might still yield positive returns, thereby stabilizing your overall portfolio.

- International Exposure: Don’t limit yourself to the Australian market. By investing in foreign markets, you can tap into different growth opportunities and reduce your overall risk. For example, while the Australian economy may be facing a downturn, markets in Asia or North America could be thriving, providing potential gains that are independent of local economic issues.

- Investing in Different Financial Instruments: While stocks and bonds are common, consider incorporating alternative investments such as real estate or commodities like gold. Real estate can act as a physical asset providing stable income, while commodities often hold their value during inflationary periods. This blend can add a strong layer of protection against market fluctuations.

Applying these strategies effectively requires ongoing assessment and adjustment of your portfolio. Regularly reviewing your investment allocations can help you respond to changing market conditions and personal financial goals. For instance, if you’ve invested heavily in Australian mining stocks and the sector faces a slump, reallocating some of those funds into international equities or defensive sectors can shield your overall wealth.

In Australia, where economic factors can be influenced by global shifts and domestic policies, being proactive about diversification is critical. Achieving a **well-diversified portfolio** not only minimizes risk but also creates pathways for long-term financial success. Understanding these strategies equips you to navigate the complexities of investing with a strategic mindset, preparing you for both opportunities and challenges ahead.

Understanding the Importance of Regular Reviews and Rebalancing

Diversification is not a one-time act; it is an ongoing process that requires regular monitoring and adjustments. As the value of your assets changes, so does the proportional allocation within your portfolio. This is why regular reviews are essential for maintaining an effective diversification strategy. One of the core aspects of this process is rebalancing, which involves realigning the weightings of the portfolio to the original or desired level of asset allocation.

Consider a simple example: if you initially allocated 60% of your investment to stocks and 40% to bonds, due to a booming stock market, your stock allocation might rise to 70% over time. While this may seem beneficial, it also increases your risk exposure. Rebalancing would mean selling off some of those stocks to return to your intended 60/40 split, thus reinstating your original risk profile.

Utilizing Financial Tools and Services

In today’s digital age, there are various financial tools and platforms that help streamline the process of monitoring and rebalancing your investment portfolio. Many of these services offer automated rebalancing features, which calculate when your allocations have drifted significantly from your desired targets. For investors who might feel overwhelmed with managing their investments, robo-advisors can provide guidance tailored to your individual risk profile and investment objectives.

Furthermore, engaging with a financial advisor can provide invaluable insights. Advisors can assist in crafting a personalized strategy based on your financial goals, risk tolerance, and market conditions. They can also help you navigate complex investment products and help you understand the nuances of asset classes, which is particularly important in a diverse market landscape like Australia.

Considering the Role of Economic Indicators

Another layer to effective diversification is staying informed about economic indicators. These indicators, such as interest rates, inflation rates, and unemployment rates, can heavily influence market performance and asset values. For instance, if Australia’s economy shows signs of slowing growth, this might suggest a shift in asset preferences. Lower interest rates could make bonds less attractive, while stocks might exhibit volatility. Being aware of these shifts can alert you to reallocate or adjust your investments in a timely manner.

Additionally, understanding global economic trends is vital, especially in an interconnected world. Changes in major economies, such as the United States or China, can have ripple effects on Australian markets. By diversifying internationally and monitoring these trends, you can position your portfolio to withstand potential downturns caused by external factors.

Learning from Historical Market Trends

Lastly, examining historical market trends can provide perspective on how various investments behave through different economic cycles. For example, during the 2008 financial crisis, sectors such as real estate faced significant downturns while others like utilities remained relatively stable. Analyzing this data helps to inform your diversification decisions, reinforcing the importance of including various asset types and sectors in your portfolio.

Adopting a proactive approach to diversification, including regular reviews and rebalancing, awareness of economic indicators, and learning from historical trends, can create a resilient investment portfolio. These concepts equip you with the necessary tools to navigate the complexities of investing, ultimately mitigating risks in your investment journey.

Final Thoughts on Diversifying Your Investment Portfolio

In conclusion, effectively diversifying an investment portfolio is essential for managing risks and enhancing the potential for returns. As we have explored, maintaining a diverse mix of asset classes, such as stocks, bonds, and alternative investments, can shield your portfolio from the volatility of any single sector or market. Regular reviews and rebalancing are fundamental to preserving your intended risk profile over time, as they ensure that your allocations remain aligned with your financial goals and market changes.

Utilizing modern financial tools, such as automated rebalancing services and the expertise of financial advisors, can simplify the monitoring process and help tailor your investment strategy. Furthermore, staying informed about economic indicators and global trends can provide critical insights for timely adjustments, reinforcing your portfolio’s resilience in a changing market landscape.

Lastly, learning from historical market trends equips you with valuable lessons that can guide your investment choices. By understanding how different assets react to economic fluctuations, you can better navigate future uncertainties. Remember, diversification is not just about spreading your investments; it’s about smartly balancing risk and reward to secure your financial future. Embrace these strategies, and you’ll be well on your way to creating a robust and well-rounded investment portfolio that helps you weather the storms of the market.

Linda Carter is a writer and financial expert specializing in personal finance and financial planning. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her knowledge on the Take Care Garden platform. Her goal is to empower readers with practical advice and strategies for financial success.