The role of financial education in everyday life

Financial education is crucial for navigating today’s economic landscape. It equips individuals with skills in budgeting, saving, investing, and managing debt. By enhancing financial literacy, one can make informed decisions, prepare for future challenges, and achieve personal goals, ultimately leading to a more secure and prosperous life.

How to Build a Diversified Investment Portfolio

This article explains the importance of building a diversified investment portfolio to manage risk and pursue growth. It emphasizes assessing personal risk tolerance and investment goals, selecting appropriate asset classes like stocks, bonds, and real estate, and periodically rebalancing the portfolio to align with changing circumstances.

What are ETFs and how to invest in them

This article explains the growing popularity of Exchange-Traded Funds (ETFs) among Australian investors. It highlights their benefits, such as diversification, liquidity, and lower costs, along with practical steps for investing in ETFs, including selecting the right brokerage, identifying suitable funds, and executing trades to achieve financial growth.

How to Start Investing with Little Money and Get Good Returns

The article explores how individuals can start investing with minimal funds, highlighting options like ETFs, robo-advisors, and micro-investing apps. It emphasizes the importance of strategies such as compounding returns and dollar-cost averaging, providing practical tips for effective wealth-building while fostering financial education and discipline.

How to Use Sustainable Investments to Align Values and Finances

The article explores the growing trend of sustainable investments, highlighting how individuals can align their financial goals with personal values. It emphasizes the importance of environmental impact, social responsibility, and governance standards. Strategies for effectively implementing these investments are discussed, along with the benefits of fostering positive social and ecological outcomes.

Tips for Saving and Investing While Traveling

This article provides essential tips for managing finances while traveling, emphasizing effective budgeting, leveraging discounts, and exploring investment opportunities. It highlights the importance of using technology for expense tracking, prioritizing spending, and participating in loyalty programs, ensuring travelers can enjoy their journeys without compromising financial stability.

How to Evaluate the Profitability of Different Types of Investments

Assessing investment profitability involves understanding risk versus reward, time horizons, and market conditions. Key asset types—equities, fixed income, real estate, and commodities—offer unique characteristics that influence returns. Utilizing advanced evaluation techniques, such as discounted cash flow and risk-adjusted metrics, enables informed investment decisions for both novices and seasoned investors.

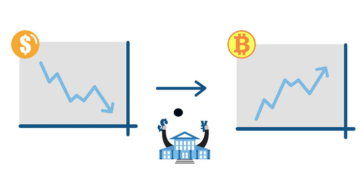

How to Safely Deal with Fluctuations in the Cryptocurrency Market

This article emphasizes the need for investors to adopt strategies to manage the cryptocurrency market's volatility. Key approaches include continuous education, emotional discipline, diversification, and technical analysis, along with practical tools like stop-loss orders. Engaging in community discussions also enhances awareness and resilience amid market fluctuations.

How to Invest in Technology Company Stocks Smartly

Investing in technology stocks offers significant opportunities but requires a strategic approach. Key strategies include understanding market trends, evaluating financial health, diversifying portfolios, and focusing on sustainable practices. Staying informed and adapting to market dynamics can enhance investment outcomes in this fast-evolving sector.

Advantages and Risks of Investing in Startups and Early-Stage Companies

Investing in startups offers high return potential and portfolio diversification while allowing engagement with innovative technologies. However, investors face risks such as high failure rates, illiquidity, and market uncertainty. A balanced understanding of these factors is crucial for navigating the dynamic startup investment landscape effectively.