Behavioral Finance: How Emotions Influence Our Financial Decisions

This overview explores how emotions and cognitive biases significantly impact our financial decisions. By understanding these influences, individuals can improve their financial well-being. Strategies such as self-reflection, setting clear goals, and seeking professional guidance empower smarter choices, fostering resilience and promoting financial success in a complex landscape.

How to Deal with Financial Unexpected Events Without Going Into Debt

Life can present unexpected financial challenges that threaten stability. To navigate these situations without accruing debt, it's essential to build an emergency fund, assess your budget, explore assistance options, and understand credit. Proactive habits and flexibility are key to maintaining financial health amid uncertainties.

Steps to Build a Solid Emergency Fund

Building an emergency fund is vital for financial security, especially in unpredictable times. Start by assessing your expenses and setting realistic savings goals. Choose a high-interest account and automate contributions for consistent growth. Regularly review your fund to adapt to life changes and ensure lasting peace of mind.

Tips to Understand Bank Fees and Avoid Unnecessary Charges

Navigating bank fees can be challenging, but understanding common charges like monthly fees, ATM costs, and overdraft penalties empowers you to manage your finances better. By employing proactive strategies and staying informed, you can minimize unnecessary expenses and enhance your financial control.

How to correctly interpret your bank statement

Mastering your bank statement is essential for effective personal finance management. By understanding key components like account balances, transaction details, and fees, you can track spending, make informed decisions, and optimize savings. Regular analysis empowers you to identify trends, manage budgets, and protect against fraud, leading to better financial health.

What is financial education and why is it essential

Financial education equips individuals with essential skills to manage their finances effectively, including budgeting, investing, and debt management. It fosters informed decision-making, promotes financial resilience, and empowers individuals to build wealth. Ultimately, a financially literate population enhances personal well-being and contributes to a stronger, more stable economy.

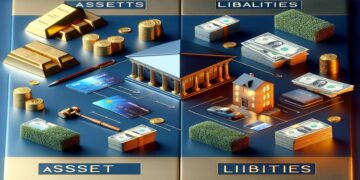

Difference between assets and liabilities in financial education

Understanding the difference between assets and liabilities is crucial for effective financial management. Assets contribute positively to your wealth while liabilities represent debts that can strain your finances. Balancing both is essential for building a stable financial future and achieving long-term financial independence.

Apps that Help Manage Personal Finances

Managing personal finances can be simplified with various apps designed for budgeting, expense tracking, and investment monitoring. Popular choices in Australia include MoneyBrilliant, Pocketbook, and YNAB. These tools enhance financial literacy, facilitate better decision-making, and promote healthier spending habits, paving the way for long-term financial stability.

The impact of credit score on personal finances

Credit scores are crucial for personal financial health, influencing loan approvals, interest rates, rental applications, and even insurance premiums. Maintaining a strong credit score can unlock better financial opportunities and reduce long-term expenses, making it essential to proactively manage and monitor one's credit profile for a secure financial future.

Simple Methods to Save Money Every Month

Saving money is crucial in today's economic climate. Key strategies include tracking expenses, creating a budget, reducing subscriptions, and embracing smart shopping habits. By adopting a savings mindset and practicing mindful spending, individuals can significantly enhance their financial health and work towards greater stability and peace of mind.