The Role of Behavioral Finance in Investment Decision-Making

Understanding Behavioral Finance

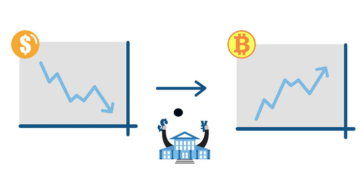

Investment decisions often rely heavily on emotion and psychology, making them less about cold hard facts and more about human nature. The discipline of behavioral finance addresses this contradiction, offering insights into why individuals behave the way they do when it comes to managing their investments. Unlike traditional finance, which assumes all investors are rational and markets are efficient, behavioral finance acknowledges that emotions and psychological factors play a significant role in decision-making.

One of the key concepts in behavioral finance is the presence of cognitive biases. Cognitive biases are systematic patterns that lead individuals to make decisions that defy logic. For instance, overconfidence is a common bias where investors overestimate their knowledge or predictive abilities. This can lead to excessive trading or concentration in certain stocks rather than a diversified portfolio. An example of this is during the dot-com bubble of the late 1990s, where investors believed they could predict the next big tech success, often ignoring underlying financial fundamentals.

Another significant factor in behavioral finance is emotional reactions. Emotions like fear and greed can cloud judgment and skew an investor’s ability to make balanced choices. During market downturns, fear can lead to panic-selling, causing substantial losses. Conversely, during market booms, the excitement can prompt investing without sufficient research, sometimes resulting in significant losses when the market corrects. For example, during the 2008 financial crisis, many investors pulled out of the market entirely at significant loss, often missing the subsequent recovery.

Additionally, social influences can profoundly impact investment choices. The actions of peers, market trends, and social media can create herd behavior, where individuals follow the crowd rather than basing decisions on their analyses. The rise in popularity of certain stocks, like GameStop in 2021, exemplifies how social influences can lead to drastic price fluctuations that seem disconnected from intrinsic value.

Recognizing the role of these psychological factors is essential for honing better investment decision-making. By understanding how emotions and biases distort judgment, investors can develop strategies to mitigate their impact. For instance, maintaining a disciplined investment plan, avoiding impulsive trading based on news headlines, and continually educating oneself about financial fundamentals can help in navigating these emotional waters more effectively.

In this article, we will delve deeper into various behavioral finance concepts, analyze their effects on investment strategies, and explore how applying this knowledge can lead to more informed financial decisions. Through understanding behavioral finance, investors can not only guard against emotional pitfalls but also enhance their overall understanding of the market.

CHECK OUT: Click here to explore more

The Impact of Cognitive Biases on Investment Decisions

Cognitive biases profoundly influence how investors perceive risks and opportunities in the market. These biases are often ingrained mental shortcuts that can lead to irrational decisions. Understanding them can empower investors to recognize when these biases might be affecting their judgment and help them make more informed choices.

Some of the most prevalent cognitive biases that impact investment decision-making include:

- Anchoring: This bias occurs when investors fixate on specific information, such as a stock’s past price or earnings report, which can prevent them from seeing new, relevant information. For example, if an investor buys a stock at $100 and becomes anchored to that price, they may refuse to sell it later at $80, thinking they need to wait until it returns to their initial purchase price.

- Confirmation Bias: Investors often seek information that confirms their existing beliefs while disregarding information that challenges those beliefs. If an investor is bullish on a particular technology stock, they may focus only on favorable news articles or reports while neglecting potential red flags. This can lead to additional losses if the investor remains unduly confident in their position.

- Loss Aversion: Psychological research suggests that people experience the pain of a loss more acutely than the pleasure of a gain. This can lead investors to hold onto losing stocks in the hope that they will rebound, rather than cutting their losses and reallocating their capital to more promising opportunities. For instance, an investor might hold onto a declining asset instead of investing in a growing company, resulting in missed opportunities for gains.

By recognizing these biases, investors can adjust their attitudes and behaviors, leading to better financial outcomes. For example, employing a strategy of diversification can help mitigate the effects of anchoring and loss aversion. By spreading investments across various asset classes, an investor can reduce the emotional impact of any single losing investment.

Moreover, self-awareness is crucial in combating cognitive biases. Investors can benefit from maintaining a reflective journal to document their decisions and the reasoning behind them. Revisiting these entries can provide insights into recurring thought patterns and help improve future decision-making.

It is also advisable to incorporate periodic portfolio reviews as a strategy for overcoming these biases. During these reviews, investors can assess their holdings against market data, financial analysis, and personal goals, rather than relying solely on emotional reactions to market movements. An objective perspective can lead to more rational investment choices and foster a data-driven approach to managing a portfolio.

In conclusion, understanding the role of cognitive biases within behavioral finance is essential for investors seeking to refine their decision-making process. By becoming aware of these psychological pitfalls and developing strategies to address them, investors can navigate the complexities of the market with greater confidence and clarity.

SEE ALSO: Click here to read another article

The Influence of Emotions on Investment Choices

While cognitive biases greatly affect investor behavior, emotions also play a significant role in shaping investment decisions. Emotional responses can often lead to impulsive actions that deviate from rational thinking, making it essential for investors to recognize how their feelings can cloud their judgment.

One common emotional driver is fear. The fear of losing money can provoke panic selling during market downturns. For instance, during the COVID-19 pandemic, many investors quickly sold stocks as the market plummeted, driven by panic rather than rational analysis of the fundamentals of the investments. By succumbing to fear, investors often lock in losses and miss out on recovery opportunities when the market rebounds.

On the other side of the spectrum is greed. Investors may become overly enthusiastic about rapid price increases, lured by the prospect of quick gains. This emotional exuberance can lead to speculative bubbles, where asset prices soar far beyond their intrinsic value. A classic example is the dot-com bubble of the late 1990s when many investors poured money into internet-based companies without examining their business models or revenue prospects, ultimately resulting in significant financial losses when the bubble burst.

Overconfidence is another emotional aspect that can hinder investors. When individuals believe they have superior knowledge or skills, they may underestimate risks or overestimate their ability to predict market movements. For example, during a bull market, an investor might become excessively confident about their stock-picking abilities, leading them to concentrate their investments in a few high-risk stocks. When the market corrects, such investors can face devastating losses due to their inability to diversify their portfolios effectively.

To mitigate the adverse effects of emotions on investment decisions, it is crucial for investors to adopt a systematic approach. One method is setting predefined investment goals and sticking to a strategic investment plan. Having clear objectives can help investors remain focused and avoid being swayed by market fluctuations or emotional responses.

Another technique to manage emotional reactions is through the practice of mindfulness or emotional regulation exercises. Investors can benefit from pausing before making a decision, especially during volatile market conditions. Taking a moment to reflect on the reasons behind their feelings can provide clarity and prevent knee-jerk reactions that may lead to regrettable decisions.

Furthermore, employing the use of automated investment strategies, like dollar-cost averaging, can lessen the impact of emotions. This method involves investing a fixed amount of money at regular intervals, regardless of market conditions, which can help investors avoid emotional pitfalls and reduce the temptation to time the market.

By recognizing the emotional aspects of investment decision-making and implementing strategies to manage these feelings, investors can foster a more disciplined and rational approach, ultimately leading to more successful outcomes in their investment journeys.

SEE ALSO: Click here to read another article

Conclusion

In summary, behavioral finance offers valuable insights into the complexities of investment decision-making by highlighting the impact of psychological factors on financial choices. The interplay of cognitive biases, such as overconfidence and loss aversion, along with emotional influences like fear and greed, underscores the necessity for investors to be aware of their own behavior and reactions.

To navigate the unpredictable nature of financial markets more effectively, it is essential for investors to adopt strategies that promote rational decision-making. Setting clear investment goals, practicing mindfulness, and utilizing automated investment methods such as dollar-cost averaging can aid in mitigating the emotional turbulence that often accompanies investing. These techniques equip investors with the tools needed to resist impulsive behaviors and remain committed to their long-term strategies, even amidst volatile market conditions.

Ultimately, understanding the principles of behavioral finance not only enriches investors’ perspectives but also empowers them to make more informed and disciplined decisions. By recognizing the human element in finance, investors can improve their performance and achieve a greater sense of confidence in their investment journeys. As our financial landscapes continue to evolve, embracing the lessons of behavioral finance could be the key to unlocking better investment outcomes and fostering a more stable connection to the markets.

Linda Carter is a writer and financial expert specializing in personal finance and financial planning. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her knowledge on the Take Care Garden platform. Her goal is to empower readers with practical advice and strategies for financial success.