The Role of Technology in the Dissemination of Real-Time Financial Information

Technological Advancements in Finance

In the realm of finance, technology plays a pivotal role in transforming how investors and organizations operate. The ability to obtain real-time financial information is not merely an advantage but a necessity in today’s competitive markets. Instantaneous access to vital data drastically influences decision-making processes, allowing market participants to act swiftly and effectively.

Various technological innovations have been integral in catalyzing this advancement. One such innovation is high-frequency trading platforms, which utilize algorithms to automate and expedite the trading process. This technology allows investors to process thousands of orders in mere milliseconds, capitalizing on minute price fluctuations that traditional trading methods cannot efficiently exploit. For instance, firms like Renaissance Technologies employ sophisticated strategies and high-frequency trading to achieve substantial returns.

Furthermore, the rise of mobile applications has empowered investors by enabling them to monitor market trends and stock prices from virtually anywhere. Platforms such as Robinhood and E*TRADE have made trading accessible to the masses, facilitating on-the-go investment opportunities for everyday individuals and seasoned traders alike.

Data analytics tools have also become vital for modern investors. By leveraging big data, these tools provide deep insights that guide strategic decision-making. For example, platforms like Bloomberg Terminal offer comprehensive analytics that enable investors to analyze market movements and economic indicators, allowing them to formulate informed investment strategies that align with market conditions.

Social media has emerged as a powerful force that shapes market sentiments. Platforms like Twitter and LinkedIn can significantly influence the way information spreads, allowing rumors and news to travel rapidly. For example, when influential figures tweet about specific stocks or economic conditions, their audience’s reactions can lead to swift market movements, thereby impacting stock prices almost instantly.

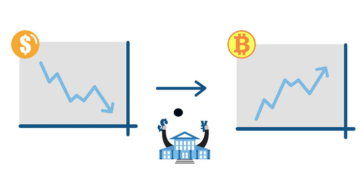

Moreover, the advent of blockchain technology has revolutionized transaction security and transparency in finance. This technology allows for secure, decentralized transactions that can be completed more quickly than traditional methods. For instance, cryptocurrencies such as Bitcoin utilize blockchain technology to ensure that transactions are not only secure but also traceable, enhancing trust among users.

The convergence of these technologies has yielded several critical outcomes that have transformed the financial landscape. Firstly, there is a noticeable improvement in market efficiency. With the ability to execute transactions swiftly, market delays are minimized, leading to more accurate pricing of assets. Secondly, increased accessibility ensures that both retail and institutional investors have simultaneous access to vital information, thereby leveling the playing field. Lastly, enhanced transparency through real-time data availability instills trust in market participants, as investors can analyze and validate their positions with greater confidence.

As technology continues to evolve, the mechanisms through which financial information is disseminated will undergo further transformation, reshaping the trading environment for both institutional and retail investors. The implications of these changes extend beyond mere convenience, fundamentally altering how information influences market behavior and investment strategies in the United States and globally.

CHECK OUT: Click here to explore more

Transformative Impact of Technology on Financial Data Accessibility

The integration of technology in finance has catalyzed unprecedented changes in the way real-time financial information is accessed and utilized. As market dynamics are increasingly driven by data, the demand for timely and relevant information has intensified. This evolving landscape has drawn attention to the core role of technology in meeting these demands, transforming both the efficiency of market operations and the strategies employed by investors.

One of the primary drivers of real-time financial information dissemination is the widespread adoption of data aggregation platforms. Services like Yahoo Finance and Google Finance consolidate vast quantities of data from numerous sources, making it easily accessible to users. They provide real-time updates on stock prices, economic indicators, and breaking news that can significantly influence market sentiment. The ability to access aggregate data fosters an environment where investors can make decisions based on the most current information available.

Moreover, cloud computing has emerged as a game changer in the financial sector. By enabling the storage and processing of large datasets remotely, cloud technology allows financial institutions to analyze data at scale and share findings with their clients in real time. This fosters collaboration and enhances the decision-making capabilities of investors. For example, companies like Goldman Sachs and Morgan Stanley leverage cloud-based analytics to provide their clients with up-to-date market insights and research, facilitating faster investment decisions.

In addition to data aggregation and cloud computing, the role of artificial intelligence (AI) and machine learning in financial markets cannot be overlooked. These technologies analyze complex datasets to detect patterns and trends that human analysts may miss, significantly enhancing predictive capabilities. AI-driven tools can process news articles, earnings reports, and social media content to provide real-time sentiment analysis, enabling investors to gauge market reactions instantly. Tools like Kensho, which pulls in vast datasets, have been used by top financial institutions to improve investment strategies through enhanced data interpretation.

Furthermore, the impact of online trading platforms cannot be overstated. Platforms such as Fidelity and Charles Schwab have revolutionized how individuals trade by providing real-time access to market information and transaction capabilities. Investors can execute trades directly from their smartphones or computers, significantly reducing the lag between information acquisition and action. This immediacy empowers retail investors to respond to market changes on par with institutional players.

To summarize, technology is fundamentally reshaping the accessibility and utility of real-time financial information. The following key aspects highlight this transformation:

- Data Aggregation Platforms: Facilitate easy access to comprehensive market information.

- Cloud Computing: Enhances data storage and real-time analytics capabilities.

- Artificial Intelligence: Provides advanced predictive insights through pattern analysis.

- Online Trading Platforms: Enable instantaneous transactions and market engagement.

As we delve deeper into the pivotal technologies fostering these advancements, it becomes increasingly evident that the evolution of financial information dissemination is not merely an ancillary development but a central component to modern financial operations. Understanding these technological dynamics is essential for investors aiming to navigate the intricacies of today’s markets effectively.

CHECK OUT: Click here to explore more

Enhancing Decision-Making Through Real-Time Data Analysis

As the financial landscape becomes increasingly complex, the necessity for real-time data analysis rises proportionally. The evolution of technology not only enhances the speed and accessibility of financial data but also enriches the analytical capabilities available to market participants. These advancements are integral in facilitating informed decision-making processes.

Real-time analytical tools equipped with advanced algorithms have emerged as a crucial asset in the investor’s toolkit. These tools utilize high-frequency data feeds that allow investors to execute trades based on immediate market conditions. For instance, platforms like TradeStation provide users with sophisticated charting and analysis capabilities, enabling them to visualize market trends and volatility. The use of such platforms empowers traders to react swiftly to market movements, potentially gaining a competitive edge in crowded trading environments.

Furthermore, subscription-based financial news services, such as Bloomberg Terminal or Reuters Eikon, have become cornerstone resources for finance professionals. These services offer comprehensive news coverage, analytics, and the ability to monitor market events as they unfold. This constant inflow of real-time information can be crucial for traders and portfolio managers, as they can adjust their strategies promptly in response to breaking news or market shifts, thereby mitigating risks and capitalizing on emerging opportunities.

Another noteworthy advancement is the utilization of blockchain technology in the financial sector, particularly in the realm of transaction transparency and security. Blockchain provides a decentralized ledger that can record transactions in real time, significantly reducing the time lag associated with traditional trading systems. Companies such as Overstock and companies within the cryptocurrency space have shown how blockchain can facilitate quicker settlements and enhance trust among stakeholders. This technology not only speeds up the transaction process but also ensures that the data remains tamper-proof, thereby fostering greater consumer confidence in financial markets.

Moreover, the rise of mobile trading applications represents a paradigm shift in how real-time financial information is accessed and acted upon. Applications like Robinhood and Webull allow users to buy and sell securities at their convenience, while simultaneously providing real-time data feeds. This accessibility democratizes trading, empowering retail investors to engage in the financial markets with immediacy and efficacy similar to institutional investors. The mass appeal of these applications is evidenced by millions of downloads and active users, highlighting the consumer’s appetite for real-time, actionable financial information.

Additionally, the increasing reliance on data visualization techniques cannot be overlooked. Tools such as Tableau and Power BI harness the power of graphical representations to simplify complex data sets, making it easier for investors to grasp essential trends and insights. This focus on visualization plays a pivotal role in enhancing comprehension among users, allowing them to process information faster and make more informed decisions regarding their investments.

Finally, the integration of social media analytics reflects how technology actively influences trading strategies. Platforms like Twitter and StockTwits provide real-time insights into market sentiment, as traders analyze trending conversations and sentiment indicators. The advent of tools that can aggregate and evaluate social media discourse helps investors to gauge public perception of stocks, commodities, and financial markets, offering an additional layer of insight into trading behavior.

In summary, the intersection of technology and real-time financial information has cultivated a dynamic environment that supports more informed decision-making processes. The following aspects illustrate the critical technologies enhancing the landscape:

- Real-Time Analytical Tools: Facilitate quick execution of trades based on immediate market conditions.

- Subscription-Based Financial News Services: Provide constant updates and analysis, enhancing responsive strategies.

- Blockchain Technology: Offers transaction transparency and security, expediting the trading process.

- Mobile Trading Applications: Enable immediate access to financial markets for retail investors.

- Data Visualization Techniques: Simplify data representation, aiding in quick comprehension.

- Social Media Analytics: Provide insights into market sentiment, influencing trading strategies.

The technological advancements driving the dissemination of real-time financial information are redefining the operational framework of the financial industry. As these technologies continue to evolve, market participants must stay informed to leverage their benefits effectively.

SEE ALSO: Click here to read another article

Conclusion

In conclusion, the integration of technology into the dissemination of real-time financial information has revolutionized the financial landscape, making it more efficient and accessible for a diverse range of market participants. The advancements outlined throughout this discussion—including real-time analytical tools, subscription-based financial news services, blockchain technology, mobile trading applications, data visualization techniques, and social media analytics—have collectively transformed how investors, traders, and financial professionals engage with information and make decisions.

With the ability to access real-time data and analytics, market participants can now respond to fluctuations and trends with unprecedented agility. This evolution not only empowers institutional investors but also democratizes access for retail investors, leveling the playing field in financial markets. Furthermore, as technology continues to advance, especially in areas like artificial intelligence and machine learning, the potential for even more sophisticated decision-making tools will grow, enabling deeper insights and innovative trading strategies.

However, it is imperative for users of these technologies to remain vigilant about the inherent risks that accompany real-time data streams, including the potential for information overload and the volatility that may arise from rapid decision-making. As we move forward, an ongoing commitment to education and adaptability will be essential for market players seeking to capitalize on the advantages offered by technology in real-time financial information dissemination. Ultimately, embracing these tools can lead to more informed investment decisions, enhanced market efficiency, and a more resilient financial ecosystem.

Linda Carter is a writer and financial expert specializing in personal finance and financial planning. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her knowledge on the Take Care Garden platform. Her goal is to empower readers with practical advice and strategies for financial success.