Investments in Cryptocurrencies: Risks and Opportunities in the North American Market

Understanding the North American Cryptocurrency Landscape

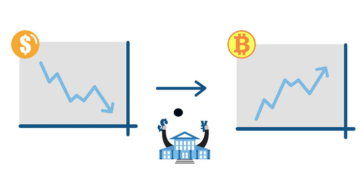

As the digital currency revolution continues to unfold across North America, it presents a myriad of potential benefits that attract investors and businesses alike. Yet, alongside these opportunities, there are also significant challenges that must be carefully navigated. With the pace of adoption quickening, gaining a comprehensive understanding of the cryptocurrency ecosystem is now more critical than ever for those looking to invest.

Investments in cryptocurrencies entail a range of factors that can significantly influence outcomes:

- Diverse Assets: The cryptocurrency market features a broad spectrum of assets, including Bitcoin, Ethereum, and thousands of altcoins, each with distinct functionalities. For instance, while Bitcoin primarily serves as a digital store of value, Ethereum enables smart contracts and decentralized applications, underpinning a wide array of innovative platforms.

- Market Volatility: The cryptocurrency market is characterized by extreme price volatility, often seeing substantial fluctuations in short timeframes. For example, Bitcoin’s price can swing thousands of dollars within a day, significantly impacting investment strategies and risk management approaches.

- Regulatory Landscape: In the United States, the regulatory framework surrounding cryptocurrencies is continually evolving. Different states have different rules, affecting everything from taxation to compliance. The U.S. Securities and Exchange Commission (SEC) often scrutinizes ICOs (Initial Coin Offerings) and trading practices, which can affect market stability and investor confidence.

- Technological Advancements: Continuous innovations in blockchain technology drive the development of new cryptocurrencies and investment opportunities. For instance, advancements in Layer 2 solutions like the Lightning Network aim to improve transaction speed and affordability, enhancing Bitcoin’s practical use cases.

Within this dynamic environment, North America—particularly the U.S.—boasts a flourishing exchange ecosystem and a growing framework for cryptocurrency initiatives. However, investors must remain vigilant as they navigate several essential considerations:

- Legal Compliance: Staying informed about the changing regulatory landscape is crucial for avoiding penalties and ensuring sustainable investment practices. The implementation of laws such as the Financial Action Task Force (FATF) guidelines affects operational standards in the sector.

- Market Trends: Regularly monitoring market trends, such as the increasing popularity of decentralized finance (DeFi) or non-fungible tokens (NFTs), can provide critical insights for anticipated gains or potential pitfalls, allowing investors to make informed decisions.

- Security Risks: Given the continuous threats posed by cybercriminals, securing cryptocurrency investments from hacks and fraud is paramount. Implementing best practices such as utilizing hardware wallets and two-factor authentication can help mitigate these risks.

In summary, the opportunities within the North American cryptocurrency market are accompanied by a complex set of challenges that necessitate informed and strategic approaches. By closely analyzing market trends and being adaptable to regulatory changes, investors can maximize their potential while minimizing risks. In this rapidly evolving domain, the empowerment gained from such knowledge can significantly impact investment success.

SEE ALSO: Click here to read another article

Identifying Key Investment Opportunities

The North American cryptocurrency market offers a diverse landscape of investment opportunities, driven by technological innovation and robust user adoption. This intriguing market is accentuated by the adoption of blockchain technologies across various sectors, resulting in transformative applications that extend far beyond simple monetary transactions. To capitalize on these opportunities, investors must identify key areas that showcase a strong potential for growth:

- Bitcoin and Established Cryptocurrencies: Bitcoin remains the flagship of cryptocurrencies, and its position as a digital store of value continues to attract institutional investors. As companies like Tesla and MicroStrategy add Bitcoin to their balance sheets, it enhances credibility and fuels demand. Similarly, established altcoins like Ethereum are popular due to their smart contract functionalities and the proliferation of decentralized applications (dApps).

- Decentralized Finance (DeFi): The DeFi sector is witnessing a meteoric rise, providing investors with opportunities to participate in lending, borrowing, and yield farming without relying on traditional financial institutions. Platforms like Uniswap and Aave have democratized access to financial services, allowing users to earn returns on their cryptocurrency holdings.

- Non-Fungible Tokens (NFTs): NFTs have emerged as a cultural phenomenon, captivating artists, creators, and investors alike. By tokenizing unique digital assets such as art, music, and virtual real estate, NFTs have opened up new revenue streams and investment avenues. As platforms dedicated to NFT trading expand, their market potential continues to grow.

- Layer 2 Solutions: The development of Layer 2 scaling solutions, such as the Lightning Network and Optimistic Rollups, is critical for enhancing transaction efficiency and reducing fees. These innovations aim to solve the scalability issues faced by major blockchains, making them an appealing investment theme as they promise to spur further cryptocurrency adoption.

As the market evolves, these avenues present a unique window for investors to explore the potential of digital currencies. However, while opportunities abound, it is paramount to evaluate the associated risks rigorously. Understanding the market dynamics is crucial for informed decision-making.

Assessing Market Dynamics and Risks

Investors must recognize that the North American cryptocurrency market does not come without its share of challenges. Some inherent risks that require careful consideration include:

- Market Sentiment and Speculation: The cryptocurrency landscape is heavily influenced by market sentiment, which often results in speculative trading behaviors. Sudden shifts in market perception can lead to dramatic price swings, increasing the risk profile for investors.

- Regulatory Uncertainty: The evolving regulatory framework presents both opportunities and threats. While regulations can foster legitimacy, abrupt changes can also create barriers for new market entrants. Investors must stay informed about potential regulatory impacts on their assets.

- Technological Security Risks: The rapid pace of technological innovation brings its own vulnerabilities. Cybersecurity threats, including hacking incidents and phishing scams, pose significant risks to investors. Adopting best security practices becomes indispensable in safeguarding investments.

Overall, while the North American cryptocurrency market holds remarkable potential, understanding and overcoming these risks is essential for long-term success. Investors who take a strategic approach by staying informed, diversifying their portfolios, and implementing strict risk management practices are better positioned to navigate this complex terrain.

CHECK OUT: Click here to explore more

Navigating the North American Cryptocurrency Ecosystem

The North American cryptocurrency ecosystem is not only influenced by investment opportunities and risks but is also greatly shaped by the presence of key stakeholders, technological advancements, and emerging trends. Investors who wish to thrive in this dynamic environment must grasp the nuances of these elements to make well-informed decisions. Below are essential considerations within the context of the cryptocurrency landscape:

- Institutional Involvement: Institutional investors have increasingly entered the cryptocurrency market, contributing to its legitimacy. Major financial institutions, such as Fidelity and Goldman Sachs, are now offering cryptocurrency services, including custodial and trading solutions. This influx of institutional money tends to stabilize the market, as these players typically have more structured investment approaches compared to individual investors. Understanding the motivations and strategies of institutional investors can provide individual investors with insights into market trends and potential investment directions.

- Technological Innovations: The rapid development of blockchain technologies has given rise to various innovations that underpin the cryptocurrency market. Concepts such as proof-of-stake (PoS) and sharding demonstrate the industry’s focus on improving efficiency and sustainability. For instance, Ethereum’s transition to a PoS consensus mechanism aims to reduce energy consumption significantly, making it more environmentally friendly. Investors should monitor these technological advancements closely, as they can have substantial impacts on market dynamics and asset valuations.

- Market Liquidity: Liquidity is a critical factor for investors in the cryptocurrency market. Compared to traditional equity markets, cryptocurrency trading often experiences lower liquidity, particularly for lesser-known assets. Illiquid markets can lead to increased volatility, as even minor trades can cause significant price fluctuations. Investors must be vigilant about liquidity levels for their chosen assets and consider utilizing larger, more liquid exchanges to minimize potential risks associated with trading.

- Global Influences: The North American cryptocurrency market is also impacted by developments in the global landscape. Countries adopting favorable regulatory frameworks, such as El Salvador’s Bitcoin adoption as legal tender, serve as benchmarks that could influence regulatory decisions in the U.S. Additionally, geopolitical events, such as trade disputes, can have further ramifications on cryptocurrency markets. Investors must maintain a global perspective to better understand how external factors can impact their investments.

As demographics shift and new generations embrace digital finance, another notable trend is the increasing interest in financial literacy and education regarding cryptocurrencies. Platforms offering educational resources aligned with investment strategies are expanding, helping to equip potential investors with the knowledge necessary to navigate the complexities of the cryptocurrency landscape. Understanding trading mechanisms, asset evaluation, and market indicators will enable investors to make data-informed choices.

Opportunities for Strategic Engagement

Engagement with various cryptocurrency platforms presents additional opportunities for investors. The rise of decentralized exchanges (DEXs) and the proliferation of cryptocurrency exchanges, such as Coinbase and Binance, offer unique avenues for trading and investing. These platforms not only facilitate transactions but also provide tools for staking, lending, and automated trading through smart contracts. Investors must explore these diversified avenues to maximize potential returns.

Moreover, the growing trend of sustainability in cryptocurrencies cannot be overlooked. As environmental concerns related to energy consumption gain traction, more investors are gravitating toward eco-friendly projects. Initiatives focusing on carbon neutrality and sustainable mining practices represent a budding segment of the market, creating exciting opportunities for responsible investors.

Overall, the North American cryptocurrency market stands at the confluence of innovation and risk. By understanding the complexities of market dynamics, institutional involvement, and global influences, investors can leverage opportunities while effectively managing potential pitfalls. This strategic approach ensures that investors remain well-oriented in an ever-evolving market landscape.

SEE ALSO: Click here to read another article

Conclusion

In conclusion, investments in cryptocurrencies within the North American market present both significant risks and promising opportunities. As the landscape rapidly evolves, investors must remain vigilant and informed about the multifaceted nature of this asset class. The entry of institutional players reflects a growing acceptance and potential stabilization of the market, while the impact of technological innovations continues to reshape traditional investment paradigms.

However, challenges such as market liquidity and global influences cannot be overlooked. These factors introduce layers of complexity that necessitate strategic planning and risk management for investors. In addition, cultivating a foundation of financial literacy is crucial, enabling potential investors to navigate the intricacies of cryptocurrencies and make data-informed decisions.

The rise of decentralized finance (DeFi) and eco-friendly cryptocurrency initiatives only enhances the investment landscape, providing various avenues for engagement and diversification. As such, informed investors who keep abreast of changes in regulatory frameworks, market trends, and technological advancements will be better positioned to capitalize on the unique opportunities this market offers.

Ultimately, successful engagement with the North American cryptocurrency market rests on a balanced approach—one that recognizes both the inherent opportunities and the significant risks. Carefully assessing these dynamics will empower investors to make choices that align with their financial goals in a landscape characterized by continual change.

Linda Carter is a writer and financial expert specializing in personal finance and financial planning. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her knowledge on the Take Care Garden platform. Her goal is to empower readers with practical advice and strategies for financial success.