The role of fintechs in the financial inclusion of underserved populations in the United States

The Impact of Fintech on Financial Services

In recent years, fintech companies have rapidly transformed financial services in the United States, particularly for those historically marginalized or overlooked by traditional banking institutions. The rise of fintech has been instrumental in offering accessible solutions to individuals who often face obstacles like poor credit scores, low income, or living in remote areas with limited banking facilities.

Accessibility

Accessibility has been significantly improved thanks to mobile applications and online platforms. Consumers can now manage their finances, apply for loans, or make transfers anytime and anywhere through their smartphones. For instance, services like Cash App and Venmo allow users to send and receive money instantly, eliminating the need to visit a physical bank branch. This feature is particularly beneficial for individuals who may not have easy access to banking facilities, such as those residing in rural communities.

Lower Costs

Fintech solutions typically offer lower fees compared to traditional banking services. For example, many fintech companies provide savings accounts with no monthly fees or low-interest rates on loans. Unlike banks that may charge substantial fees for overdrafts, fintech platforms often provide transparency about their costs upfront. This affordability is crucial for underserved populations who are trying to manage tight budgets.

Custom Services

An essential aspect of fintech innovation is the availability of custom services. Products like microloans, which allow individuals to borrow smaller amounts of money, serve those who might be ineligible for traditional loans due to insufficient credit history. Additionally, budgeting apps like Mint and YNAB (You Need A Budget) empower users to manage their finances better by providing tailored budgeting tools that meet their specific needs.

User Experience and Education

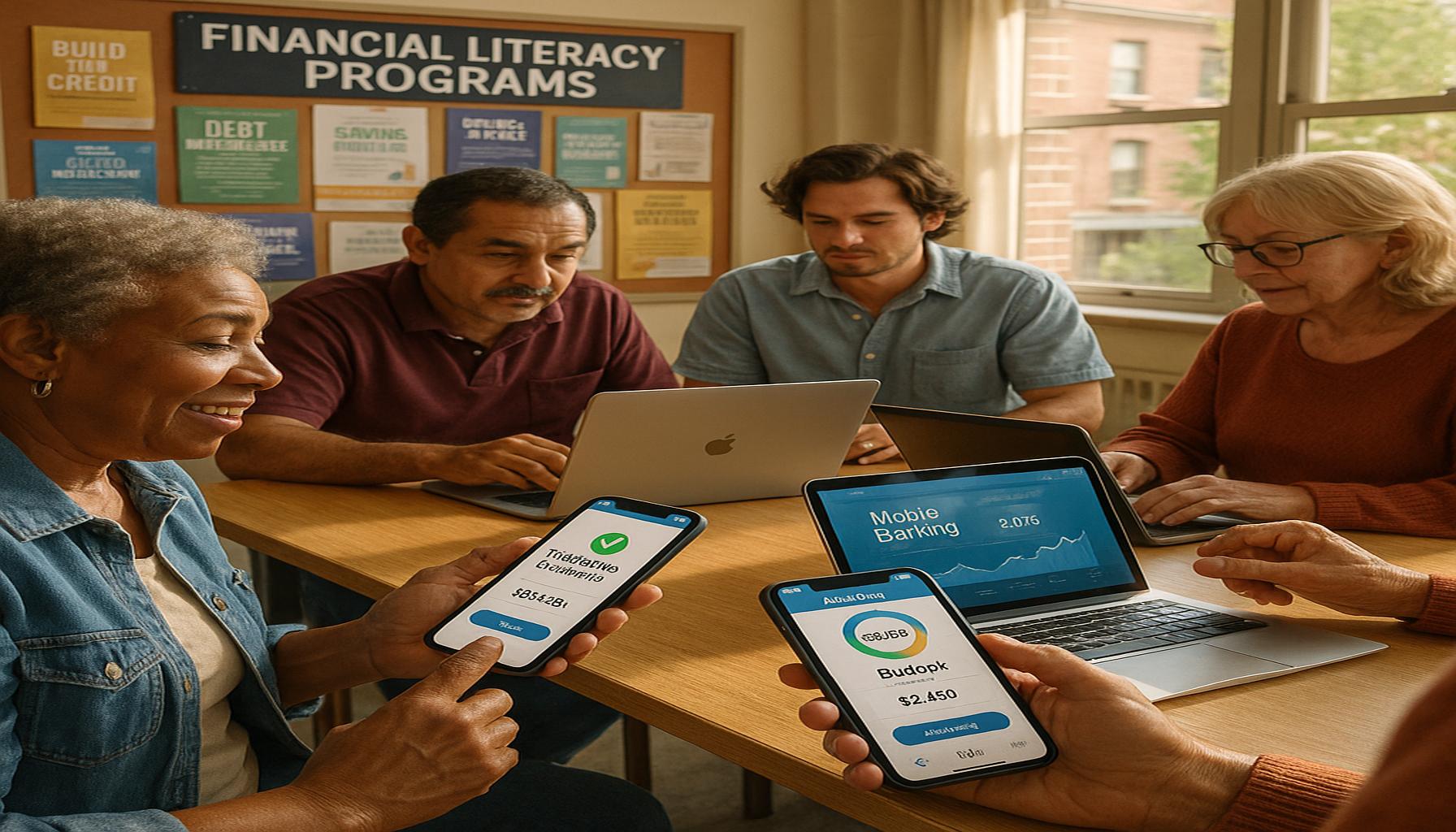

Fintech companies emphasize a user-friendly experience, aiming to cater to populations that may lack advanced technological skills. Many platforms design their interfaces to be intuitive and straightforward, making financial management accessible to everyone, regardless of their tech proficiency. Coupled with this is a strong emphasis on education. Many fintech firms offer educational resources, such as webinars, articles, and user guides, to equip customers with the knowledge necessary for making informed financial decisions.

Furthermore, fintechs often incorporate features like chatbots and customer service representatives to assist users in navigating their applications, ensuring that support is readily available. This commitment to enhancing user experience and financial literacy is vital in empowering individuals to take control of their financial futures.

In conclusion, fintech companies are revolutionizing the financial landscape for underserved communities throughout the United States. By enhancing accessibility, reducing costs, and providing custom solutions, fintechs not only enrich individual lives but also foster broader economic growth. This evolution is pivotal in creating a more inclusive financial system where everyone has the opportunity to participate in the economy, regardless of their background.

LEARN MORE: Click here to discover how to apply

Empowering Underserved Communities Through Fintech

Fintechs play a crucial role in addressing the financial needs of underserved populations in the United States. By leveraging technology to create innovative financial products and services, these companies offer solutions that are tailored to the unique challenges faced by low-income individuals, minorities, and those with limited access to traditional banking systems. To understand the extent of this impact, consider the following focal areas:

Building Credit History

In the past, building a strong credit history has been a significant barrier for many, particularly those from underserved backgrounds. Fintechs have responded by providing alternative solutions to bolster credit profiles. Here are a few methods fintechs utilize:

- Credit Builder Loans: Many fintech companies offer small loans specifically designed to help users improve their credit scores. By borrowing a small amount and making timely payments, users can demonstrate creditworthiness.

- Rent Reporting Services: Fintechs such as RentTrack allow individuals to report their rent payments to credit bureaus, enabling regular payments to contribute to their credit scores.

- Peer-to-Peer Lending: Platforms like LendingClub facilitate loans among individuals, providing an alternative for borrowers who may struggle to obtain credit through traditional institutions.

Financial Literacy and Awareness

Another area where fintechs excel is in promoting financial literacy among underserved populations. By offering educational tools and resources, these companies empower users to make informed financial decisions. Important strategies include:

- Interactive Learning Modules: Many fintech platforms feature interactive courses that teach users about budgeting, saving, and investing.

- Personalized Financial Advice: Advanced algorithms help users receive tailored advice based on their financial situation and goals.

- Visual Tools: Financial management apps often provide visual budgets and spending trackers that help individuals understand their financial patterns and make necessary adjustments.

Facilitating Access to Capital

A significant challenge for underserved populations is accessing capital for entrepreneurial endeavors. Fintechs are addressing this gap through innovative financing models that cater specifically to small business owners and aspiring entrepreneurs. Examples include:

- Microfinancing: Platforms like Kiva allow individuals to seek small loans for their businesses, providing a supportive community for borrowers.

- Accelerator Programs: Some fintech companies offer mentorship and funding to startups seeking to grow, enhancing the chances of success among marginalized entrepreneurs.

By focusing on these critical areas, fintech companies not only enhance their service offerings but also contribute to a more inclusive economy. As they continue to evolve, the potential to create long-lasting impact on financial inclusion grows, ensuring that every individual, regardless of their background, has an opportunity to thrive in the financial landscape of the United States.

DISCOVER MORE: Click here to learn about effective communication strategies

Transforming Payment Solutions for Financial Access

One of the most significant barriers facing underserved populations in the United States is limited access to traditional banking and payment systems. Fintechs are working diligently to provide accessible payment solutions that allow these communities to participate actively in the economy. Some noteworthy innovations include:

Mobile Wallets and Digital Payment Platforms

Mobile wallets have revolutionized the way people transact, particularly in underserved communities. These platforms, often powered by fintech companies, offer secure and convenient alternatives to cash and traditional banking methods. Several key features include:

- Cash Deposits and Transactions: Services like PayPal, Venmo, and Cash App allow individuals to send and receive money instantly, making it easier for those without bank accounts to manage funds.

- Bill Payment Flexibility: Users can pay bills directly from their phones, eliminating the need for physical checks or money orders, which can be costly and time-consuming.

- Accessibility of Financial Services: Many mobile wallets include features like budget tracking and expense categorization, empowering users to gain better control over their finances.

Low-Cost Banking Alternatives

Traditional banks often impose high fees that can be prohibitive for low-income individuals. Fintechs are responding by offering low-cost or fee-free banking options. Consider these alternatives:

- Neobanks: Digital banks such as Chime and Varo provide basic banking services without the overhead costs associated with physical branches. This leads to reduced fees and greater accessibility.

- Fee-Free ATMs: Many fintechs partner with extensive ATM networks to ensure users can access their cash without incurring withdrawal fees.

- Account Setup Without Minimum Balance Requirements: This allows individuals to open accounts without the initial financial burden often required by traditional banks.

Remittance Services

For many in underserved communities, remittances from family members overseas represent a vital source of income. Fintechs are making it easier and more affordable to send money across borders. Key features include:

- Lower Fees: Services like Remitly and TransferWise offer competitive rates compared to traditional money transfer services, allowing individuals to send larger portions of their hard-earned money back home.

- Faster Transfers: Fintechs often provide near-instant transfer options, which is essential for individuals relying on timely remittances to cover immediate expenses.

- User-Friendly Interfaces: Most platforms are designed for ease of use, requiring minimal financial literacy to navigate the remittance process effectively.

As fintech solutions continue to expand in these areas, they are effectively breaking down barriers that have historically impeded financial access for underserved populations. By simplifying payment processes, reducing costs, and enhancing financial literacy, fintechs are paving the way for a more inclusive financial ecosystem, allowing more individuals to participate fully in the economy.

DIVE DEEPER: Click here to uncover more insights

Conclusion

The emergence of fintechs has fundamentally altered the landscape of financial services in the United States, particularly for underserved populations. By tackling issues such as limited access, high fees, and cumbersome transaction processes, fintech companies are creating pathways for greater financial inclusion. They offer innovative solutions that not only streamline payment processes but also provide low-cost banking alternatives and efficient remittance services.

These advancements pave the way for improved financial literacy and offer tools that enhance individual economic participation. Fintechs allow users to manage their finances from the convenience of a mobile device, which is especially beneficial for those without traditional banking resources. For example, services like Cash App and Venmo allow individuals to send money instantly and without having to deal with the long waiting periods often associated with bank transactions.

To fully leverage these fintech advancements, users should take the following practical steps:

- Explore Mobile Wallet Options: Investigate platforms like PayPal and Cash App for managing transactions efficiently. These apps not only allow for easy peer-to-peer payments but can also link directly to traditional bank accounts.

- Utilize Neobanks: Consider banking with digital-only institutions such as Chime or Varo, which often provide no-fee services. These banks often have user-friendly apps that help track spending and savings in real-time.

- Compare Remittance Services: Look for services like Remitly, which offer lower fees and faster transfers for sending money home. This can be especially vital for individuals supporting families in other countries.

As these financial technologies continue to evolve, they promise to enhance economic participation among those historically marginalized in banking systems. It is essential for both consumers and policymakers to recognize and support the role of fintechs. By doing so, we can move towards a more equitable financial future where everyone has the tools they need to achieve financial security and contribute to the economy.

In conclusion, embracing fintech solutions will not only benefit individual users but also contribute to broader economic growth. By taking proactive steps to use these innovative services, consumers can better navigate their financial lives, thus fostering a more inclusive and dynamic financial environment for all.

Linda Carter is a writer and financial expert specializing in personal finance and financial planning. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her knowledge on the Take Care Garden platform. Her goal is to empower readers with practical advice and strategies for financial success.